Contents

Expenses that can’t be easily quantified are called implicit costs. These are costs that can’t be measured directly but contribute to a business’s income. https://1investing.in/ In some cases, owners of a business contribute to these costs. Examples of fixed cost are rent, tax, salary, depreciation, fees, duties, insurance, etc.

Which can be identified with a given product. Service, job or activity also form part of direct costs. These are also called traceable costs. On the other hand, indirect costs are those which cannot be readily identified with products or Services but are generally incurred in carrying out production activity. In another example, imagine a company called ABC, has a specific patent.

- However, it will not be possible to evaluate the definite value.

- The implicit cost, on the other hand, is neither recorded nor reported to the company’s management.

- All such actual payments, on purchasing and hiring different goods and services used in production are called paid out costs or explicit costs.

- Differentiate between the concept of cost as used in business and in microeconomics.

- There is yet another element of cost described as ‘normal profits’.

What is Pre-production Costs – The part of development costs incurred in making a trial production before commencing formal production is termed as pre-production cost. This cost concept is a short-term concept and is used in decisions relating to fixation of selling price in recession, make or but. Out-of-pocket costs can be avoided or saved if a particular proposal under consideration is not accepted. Costs incurred in these responsibility centers are influenced by the action of the in charge of the particular responsibility center. Thus, any cost that an organizational unit has the authority to incur may be identified as controllable cost. What is Cost Concepts and Different Terms of Costs – There are widely recognized cost concepts and terms which are often used in cost accounting.

Difference between Cost Accounting and Management Accounting

Assume you’re a new business owner who has only been in operation for a few years. You decide not to take a salary for the first two years to help pay for startup costs. Your annual salary would have been Rs 400,000.

The study material of Eduncle helps me a lot. The unit wise questions and test series were helpful. It helped me to clear my doubts. When I could not understand a topic, the faculty support too was good. What is Residual Costs – These costs can not be allocated or apportionment to a particular department cost center or product. An example is the fee paid to a consultant for advising on the replacement of and old machine.

Rent of the factory, wages of the watchman. Salary of the works managers, etc. are example of overhead expenses. All indirect costs arc ultimately charged to the product by the process of absorption.

(b) Wages to watchman

It’s difficult to give an implicit cost calculation a standard formula because it can involve a variety of situations. Implicit cost is an opportunity cost that arises from the allocation of resources for a specific purpose and cannot be easily assigned a monetary value. Let’s look at both explicit and implicit costs in more depth. Once the costs have been determined, the firm’s economic profit will be revealed.

The measure of the potential loss in decision-making is called opportunity cost. There are many choices in life. Every choice has an inherent risk of losing out on opportunities. What is Sunk Costs – Thus is historical cost incurred in the past.

Imputed costs are synonymous with implicit costs. Expenses paid out-of-pocket are called explicit costs. This resource is not explicitly reimbursed for its usage.

Purpose of Accounting System | Definition, Features and Examples

The cost incurred in putting the results of such research into use on commercial basis are called development costs. Marginal cost is the additional cost incurred for the production of an additional unit of output. Normally, in business, the accountant takes into account only the actual money expenditure as cost. So in business the cost is normally the paid-out or explicit cost only. Paid out costs helps in the calculation of both accounting profit and economic profit. Conversely, Imputed Cost helps in the calculation of only economic profit.

Because you didn’t receive a salary for three years. It might’ve been an explicit expense if you had received the salary. I am truly Statisfied with study material of Eduncle.com for English their practise test paper was really awsome because it helped me to crack GSET before NET. Eduncle example of imputed cost served as my guiding light. It has a responsive doubt solving team which solves & provides good solutions for your queries within 24 hours. Eduncle Mentorship Services guides you step by step regarding your syllabus, books to be used to study a subject, weightage, important stuff, etc.

Explicit Cost Examples

1.Actual cost of funds excluding Gross Receipts Tax is the combined cost of deposit, imputed cost on reserves, and administration cost. Average total cost is the sum of ____________ and .. Expenditure on transport to bring raw material like paper, ink etc. Businesses buy equipment to increase the efficiency of their production and output.

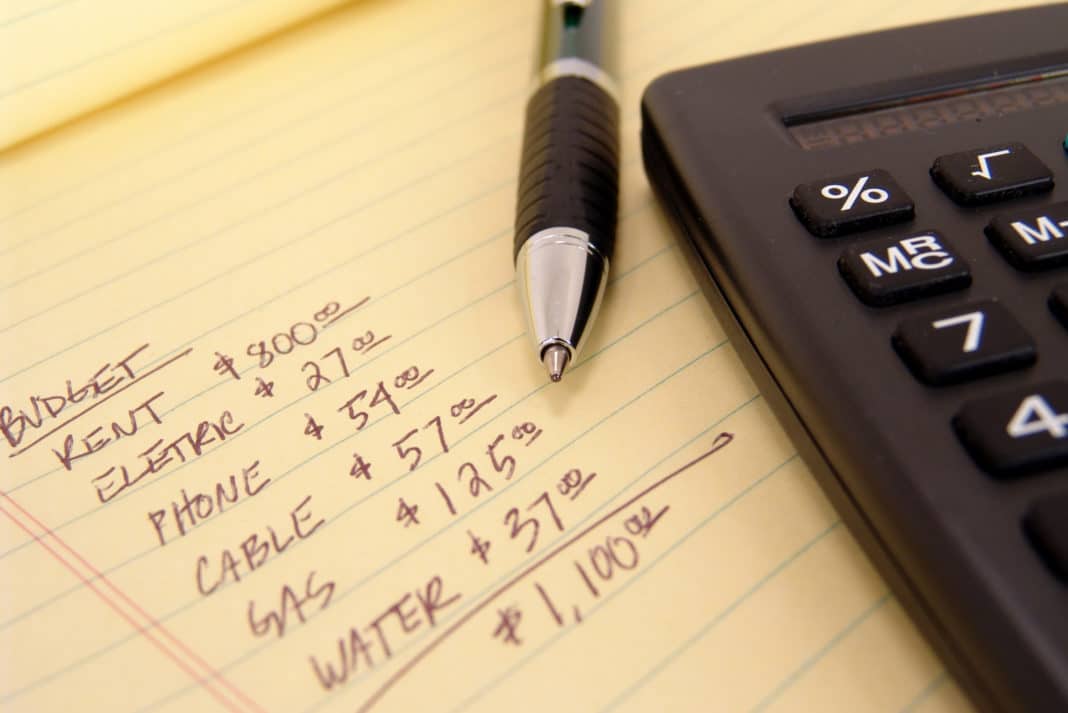

To calculate explicit costs, add up all of your business expenses on the general ledger. This could include things like insurance, rent, equipment, supplies, and the cost of goods sold, among other things. Remember that expenses can vary from one business to another. There is no single formula to calculate explicit costs.

If you spend 5 hours playing video games, for example, you will not be able to study during that time. Explicit costs can also be called opportunity costs. An organisation incurs these costs to produce its goods or services.

It’s easy to calculate if you’ve narrated the notes of your business costs. It is easy to calculate explicit costs if you understand your business costs well. Add up all your business costs to calculate explicit costs. This could also include equipment, supplies, rent, insurance and goods sold. Implicit costs are also known as notional costs or imputed costs. However, their impact is often less visible than their direct counterparts.